Navigating Medicare coverage options can be complex, especially when exploring Medicare Advantage plans like Aetna Advantra. These plans offer comprehensive healthcare coverage that goes beyond Original Medicare, providing beneficiaries with additional benefits and potential cost savings.

In this detailed guide, we'll explore how Advantra plans work, their various coverage options, and what you need to know to make an informed decision about your healthcare coverage.

Types of Aetna Advantra Plans

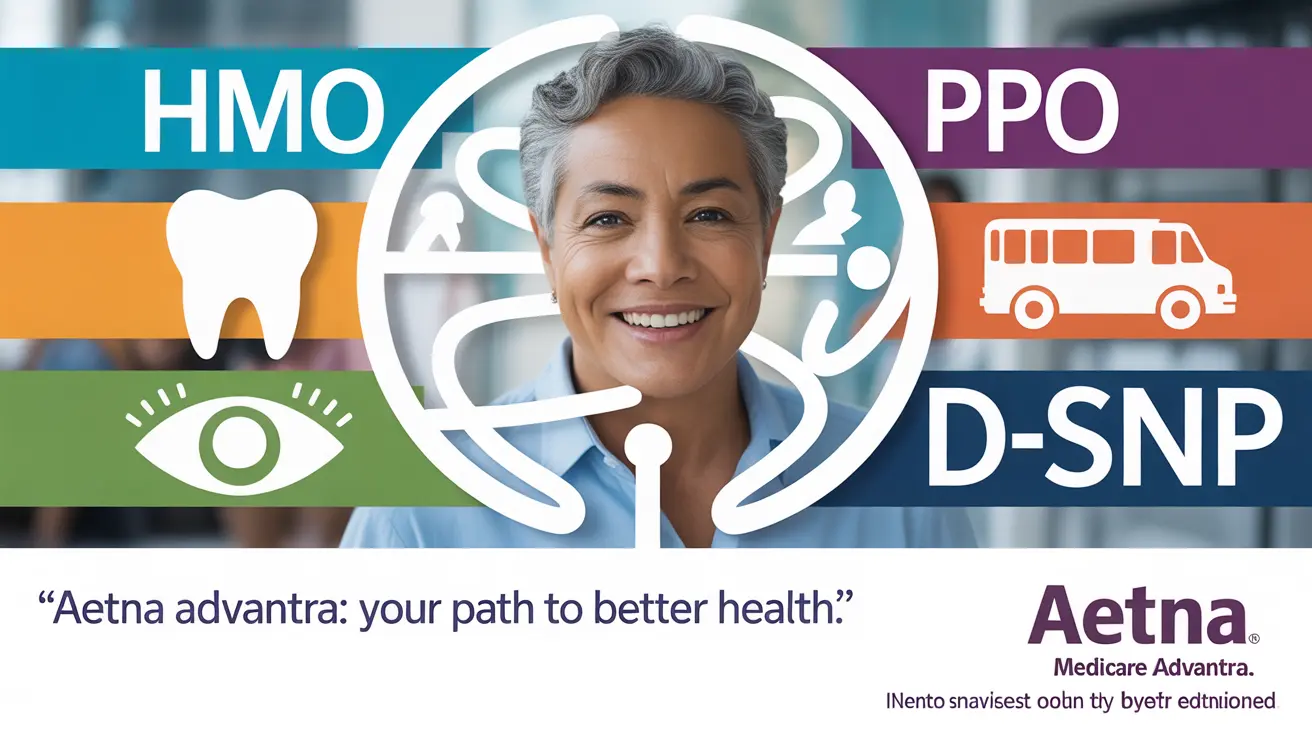

Aetna Advantra offers several Medicare Advantage plan options to meet different healthcare needs and preferences:

HMO Plans

Health Maintenance Organization (HMO) plans typically offer lower out-of-pocket costs but require members to choose providers within the network. These plans often require a primary care physician referral for specialist visits.

PPO Plans

Preferred Provider Organization (PPO) plans provide more flexibility in choosing healthcare providers, allowing members to see out-of-network doctors at a higher cost. No referrals are typically needed for specialist visits.

Dual Eligible Special Needs Plans (D-SNP)

These specialized plans are designed for individuals who qualify for both Medicare and Medicaid, offering tailored benefits and coordinated care services.

Additional Benefits and Coverage

Prescription Drug Coverage

Most Advantra plans include Medicare Part D prescription drug coverage, helping members manage medication costs through tiered pricing systems and pharmacy networks.

Extra Benefits

Advantra plans often include additional benefits not covered by Original Medicare:

- Dental care coverage

- Vision services

- Hearing aid benefits

- Fitness program memberships

- Over-the-counter health products allowance

Transportation Services

Many Advantra plans offer non-emergency medical transportation benefits, helping members get to and from medical appointments safely and reliably.

Cost Structure and Savings

Advantra plan costs vary based on several factors:

- Monthly premiums (some plans may have $0 premium options)

- Annual deductibles

- Copayments and coinsurance

- Maximum out-of-pocket limits

- Geographic location

Dual-eligible beneficiaries may qualify for significant cost reductions or eliminated out-of-pocket expenses through Special Needs Plans.

Frequently Asked Questions

What types of coverage and extra benefits do Aetna Advantra Medicare Advantage plans offer beyond Original Medicare?

Aetna Advantra plans typically offer additional benefits including dental, vision, hearing coverage, fitness programs, and over-the-counter health product allowances. Many plans also include prescription drug coverage, transportation services, and wellness programs not found in Original Medicare.

How do Aetna Advantra HMO, PPO, and Dual Eligible Special Needs Plans differ in terms of provider access and costs?

HMO plans require using in-network providers and referrals for specialists but often have lower costs. PPO plans offer more provider flexibility but may have higher costs. D-SNP plans are specifically designed for dual-eligible beneficiaries, offering specialized benefits and typically lower costs.

Does Aetna Advantra include prescription drug coverage, and how do medication costs vary within these plans?

Most Advantra plans include prescription drug coverage through Medicare Part D. Medication costs vary based on the plan's formulary tiers, with generic drugs typically costing less than brand-name medications. Some plans may offer additional coverage during the coverage gap.

What transportation benefits are included with Aetna Advantra Medicare Advantage plans, and how can members use them?

Many Advantra plans include non-emergency medical transportation benefits, providing a specific number of one-way rides annually to plan-approved locations. Members typically need to schedule rides in advance through the plan's transportation service provider.

How does the cost structure of Advantra Medicare Advantage plans vary, especially for dual-eligible beneficiaries?

Cost structures vary by plan type and location. Dual-eligible beneficiaries enrolled in D-SNP plans often have minimal to no out-of-pocket costs. Regular plans may have monthly premiums, deductibles, and copayments, with some offering $0 premium options depending on the area.