When facing surgery or medical procedures requiring anesthesia, one of the most pressing concerns patients have is whether their insurance will cover these essential services. Anesthesia costs can be substantial, and understanding your coverage options is crucial for financial planning and peace of mind.

Insurance coverage for anesthesia varies significantly depending on your specific plan type, the nature of the procedure, and whether the treatment is deemed medically necessary. This comprehensive guide will help you navigate the complexities of anesthesia coverage across different insurance plans, with particular focus on Medicare options.

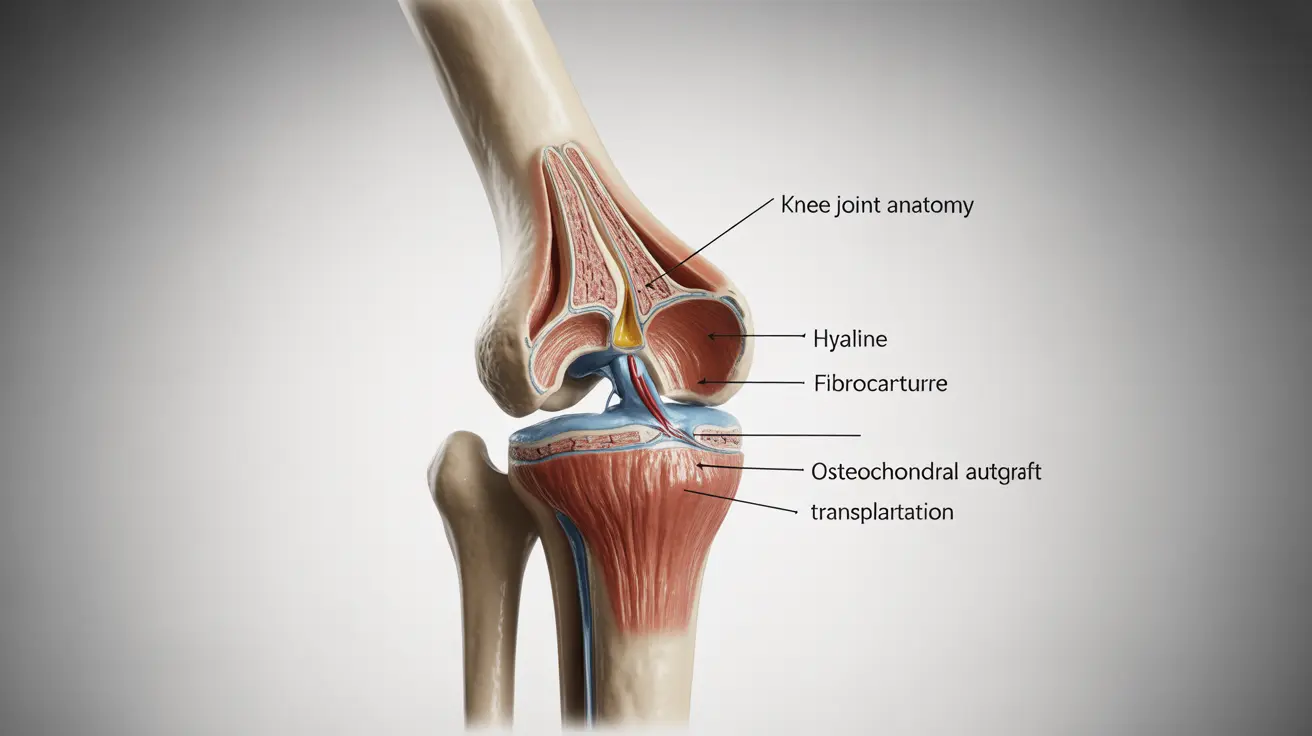

Understanding Anesthesia as a Medical Service

Anesthesia is a critical medical service that ensures patient comfort and safety during surgical procedures. Healthcare providers administer various types of anesthesia, including local, regional, and general anesthesia, depending on the complexity and duration of the procedure.

Most insurance plans recognize anesthesia as an integral part of medically necessary procedures rather than an optional add-on service. This classification typically means that when a covered procedure requires anesthesia, the anesthesia services are also covered under the same terms as the primary procedure.

Medicare Coverage for Anesthesia Services

Inpatient and Outpatient Surgery Coverage

Medicare provides comprehensive coverage for anesthesia services when they are administered during medically necessary procedures. Under Medicare Part A, anesthesia costs for inpatient hospital stays are included in the diagnosis-related group (DRG) payment system, meaning hospitals receive a bundled payment that covers all services, including anesthesia.

For outpatient procedures covered under Medicare Part B, anesthesia services are typically covered at 80% of the Medicare-approved amount after you meet your annual deductible. This coverage applies to procedures performed in hospital outpatient departments, ambulatory surgical centers, and physician offices.

Cost Considerations Under Medicare

Medicare beneficiaries should be prepared for certain out-of-pocket expenses related to anesthesia services. Under Medicare Part A, you may be responsible for the annual deductible and any applicable coinsurance for extended hospital stays. Part B coverage requires you to pay 20% of the Medicare-approved amount for anesthesia services after meeting your annual deductible.

The actual cost you pay can vary depending on factors such as the length and complexity of the procedure, the type of anesthesia required, and whether your anesthesiologist participates in Medicare's provider network.

Coverage Limitations and Exclusions

Cosmetic and Dental Procedures

Insurance coverage for anesthesia becomes more complex when dealing with procedures that are not considered medically necessary. Cosmetic surgeries, elective dental procedures, and other treatments deemed non-essential typically do not qualify for insurance coverage, including anesthesia services associated with these procedures.

However, there are exceptions when cosmetic procedures are reconstructive in nature or when dental procedures are required due to medical conditions rather than routine oral health maintenance. In these cases, prior authorization from your insurance provider may be necessary to confirm coverage.

Medicare Advantage vs. Original Medicare

Medicare Advantage plans often provide different coverage structures for anesthesia services compared to Original Medicare. These private insurance plans must offer at least the same coverage as Original Medicare but may include additional benefits or different cost-sharing arrangements.

Some Medicare Advantage plans may offer lower copayments for anesthesia services or include coverage for certain procedures that Original Medicare might not cover. However, these plans typically require you to use providers within their network, which could limit your choice of anesthesiologists.

Supplemental Insurance Options

Medigap Plans and Anesthesia Costs

Medicare Supplement Insurance, commonly known as Medigap, can significantly reduce your out-of-pocket costs for anesthesia services. These standardized plans help cover the gaps in Original Medicare coverage, including deductibles, coinsurance, and copayments.

Depending on the Medigap plan you choose, you may have minimal or no out-of-pocket costs for anesthesia services that are covered under Medicare Part A and Part B. Plans with more comprehensive coverage typically have higher monthly premiums but provide greater financial protection.

Private Insurance Considerations

If you have private insurance through an employer or individual marketplace plan, anesthesia coverage generally follows the same principles as Medicare but with potentially different cost-sharing structures. Most private plans cover anesthesia for medically necessary procedures, but you should verify specific coverage details with your insurance provider.

Private insurance plans may have different networks of anesthesiologists, prior authorization requirements, or coverage limitations that could affect your out-of-pocket costs. Always confirm that your anesthesiologist participates in your plan's network to avoid unexpected charges.

Tips for Managing Anesthesia Costs

To minimize your financial responsibility for anesthesia services, consider discussing payment options with your healthcare providers before your procedure. Many facilities offer payment plans or financial assistance programs for patients facing significant out-of-pocket costs.

Additionally, confirm that all providers involved in your care, including the anesthesiologist, participate in your insurance network. Out-of-network charges can result in significantly higher costs and may not be covered by your insurance plan.

Frequently Asked Questions

Does Medicare cover anesthesia for both inpatient and outpatient surgeries?

Yes, Medicare covers anesthesia for both inpatient and outpatient surgeries when the procedures are medically necessary. Part A covers inpatient anesthesia as part of the bundled hospital payment, while Part B covers outpatient anesthesia at 80% of the Medicare-approved amount after you meet your deductible.

What out-of-pocket costs should I expect for anesthesia under Medicare Part A and Part B?

Under Part A, you'll pay the annual deductible for inpatient stays and any applicable coinsurance for extended hospitalizations. For Part B coverage, you're responsible for 20% of the Medicare-approved amount for anesthesia services after meeting your annual deductible, which varies by year.

Is anesthesia covered by Medicare for cosmetic or dental procedures?

Medicare typically does not cover anesthesia for cosmetic procedures or routine dental work. However, coverage may apply if the procedure is reconstructive due to injury, illness, or congenital defect, or if dental surgery is required for a covered medical condition.

How does Medicare Advantage coverage for anesthesia differ from Original Medicare?

Medicare Advantage plans must provide at least the same anesthesia coverage as Original Medicare but may offer different cost-sharing structures, such as fixed copayments instead of percentage-based coinsurance. These plans may also have network restrictions that limit your choice of anesthesiologists.

Can a Medicare supplemental (Medigap) plan help reduce anesthesia costs?

Yes, Medigap plans can significantly reduce or eliminate your out-of-pocket costs for anesthesia services covered under Medicare Part A and Part B. These supplemental policies help pay for deductibles, coinsurance, and copayments that you would otherwise pay with Original Medicare alone.