Medicare is a federal health insurance program that provides essential coverage for millions of Americans aged 65 and older, as well as certain younger individuals with disabilities. Understanding Medicare basics is crucial for making informed decisions about your healthcare coverage and ensuring you receive the benefits you're entitled to.

This comprehensive guide will walk you through the fundamental aspects of Medicare, including its different parts, eligibility requirements, enrollment periods, and cost-saving options.

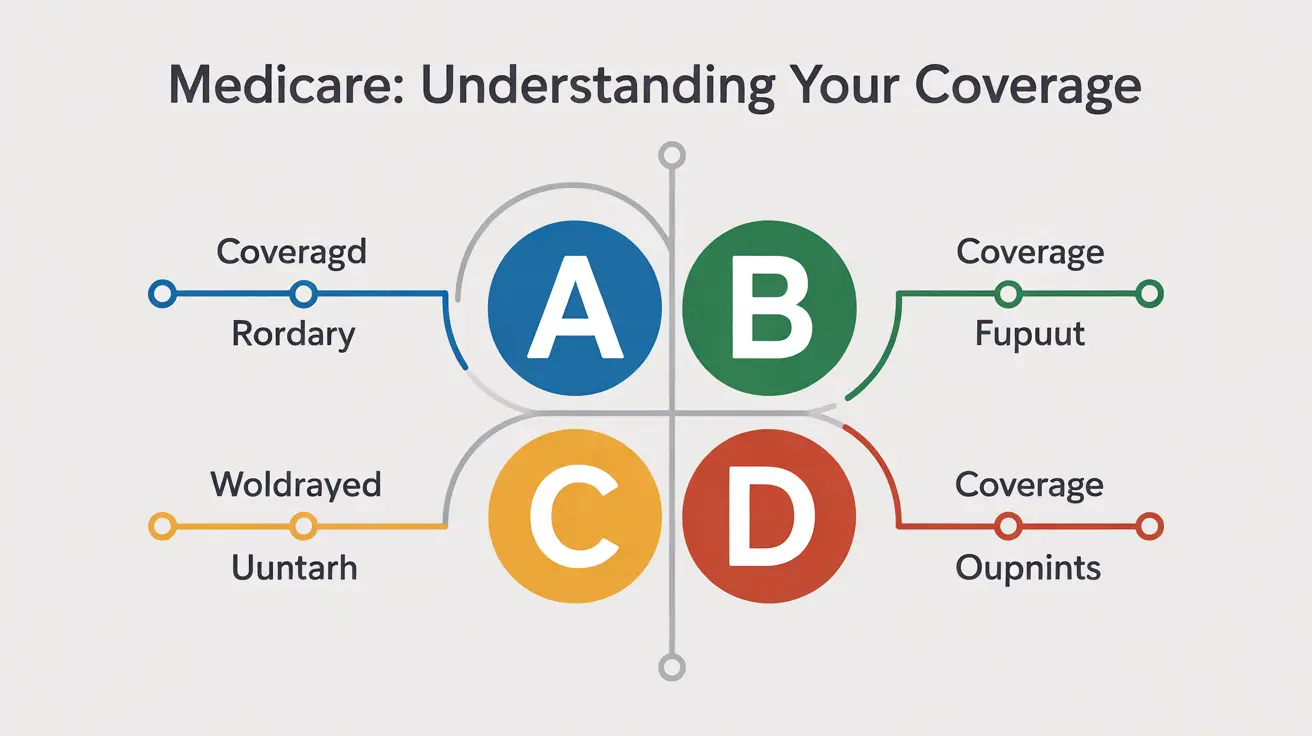

Understanding the Different Parts of Medicare

Medicare consists of several distinct parts, each designed to cover specific healthcare needs:

Medicare Part A (Hospital Insurance)

Part A covers inpatient hospital stays, skilled nursing facility care, hospice care, and some home health care services. Most people don't pay a premium for Part A if they or their spouse paid Medicare taxes while working.

Medicare Part B (Medical Insurance)

Part B covers outpatient care, preventive services, medical supplies, and some home health care. This part requires a monthly premium, which is typically deducted from your Social Security benefits.

Medicare Part C (Medicare Advantage)

Medicare Advantage plans are offered by private insurance companies approved by Medicare. These plans combine Part A and Part B coverage, and often include Part D prescription drug coverage and additional benefits like dental and vision care.

Medicare Part D (Prescription Drug Coverage)

Part D helps cover the cost of prescription medications. These plans are run by private insurance companies that follow rules set by Medicare.

Medicare Eligibility and Enrollment

Understanding when and how to enroll in Medicare is essential for avoiding late enrollment penalties and gaps in coverage.

Age-Based Eligibility

Most people become eligible for Medicare when they turn 65. Your Initial Enrollment Period (IEP) begins three months before your 65th birthday month and extends three months after.

Disability-Based Eligibility

If you're under 65, you may qualify for Medicare if you have received Social Security Disability Insurance (SSDI) for 24 months, have End-Stage Renal Disease (ESRD), or have Amyotrophic Lateral Sclerosis (ALS).

Cost Management and Financial Assistance

Several programs are available to help beneficiaries manage Medicare costs:

- Medicare Savings Programs

- Extra Help for Part D prescription drug costs

- Medicaid dual eligibility

- Supplemental insurance (Medigap) policies

Choosing Between Original Medicare and Medicare Advantage

The choice between Original Medicare and Medicare Advantage depends on various factors, including:

- Your healthcare needs and preferences

- Cost considerations

- Provider network requirements

- Geographic location

- Desired additional benefits

Frequently Asked Questions

- What are the different parts of Medicare and what does each part cover?

Medicare consists of four parts: Part A covers hospital insurance, Part B covers medical insurance, Part C (Medicare Advantage) offers an alternative to Original Medicare through private plans, and Part D covers prescription drugs.

- How do I know if I am eligible for Medicare before age 65 due to a disability?

You may qualify for Medicare before 65 if you've received SSDI benefits for 24 months, have ESRD, or have ALS. The Social Security Administration automatically enrolls eligible individuals receiving disability benefits.

- When is the best time to enroll in Medicare to avoid late penalties?

The best time to enroll is during your Initial Enrollment Period, which starts three months before your 65th birthday month and ends three months after. Enrolling during this period helps avoid permanent late enrollment penalties.

- What is the difference between Original Medicare and Medicare Advantage (Part C)?

Original Medicare includes Part A and Part B and is managed by the federal government, while Medicare Advantage plans are offered by private insurance companies and typically combine Parts A, B, and often D, along with additional benefits like dental and vision coverage.

- How can I get help with Medicare costs like premiums, deductibles, and copayments?

Several assistance programs are available, including Medicare Savings Programs, Extra Help for prescription drugs, and Medicaid for dual-eligible individuals. Contact your State Health Insurance Assistance Program (SHIP) for free counseling about these options.