When planning for long-term care and healthcare coverage, understanding look-back periods for Medicare and Medicaid is crucial. These periods can significantly impact your eligibility for benefits and the financial support you receive. This comprehensive guide will help you navigate these important considerations and make informed decisions about your healthcare coverage.

What Are Look-Back Periods?

Look-back periods are specific timeframes during which government programs review your financial history and asset transfers to determine eligibility for benefits. These periods are particularly important for Medicaid coverage, as they help prevent individuals from improperly transferring assets to qualify for benefits.

Understanding Medicaid's 5-Year Look-Back Period

Medicaid's look-back period is one of the most significant aspects of long-term care planning. This five-year review period examines all financial transactions and asset transfers made before applying for Medicaid benefits.

How the Look-Back Period Works

During the five-year review, Medicaid examines all financial transactions, including:

- Bank account transfers

- Property sales or gifts

- Stock or investment transfers

- Creation of trusts

- Below-market-value asset sales

Any transfers made during this period that don't receive fair market value compensation could result in a penalty period, during which you would be ineligible for Medicaid benefits.

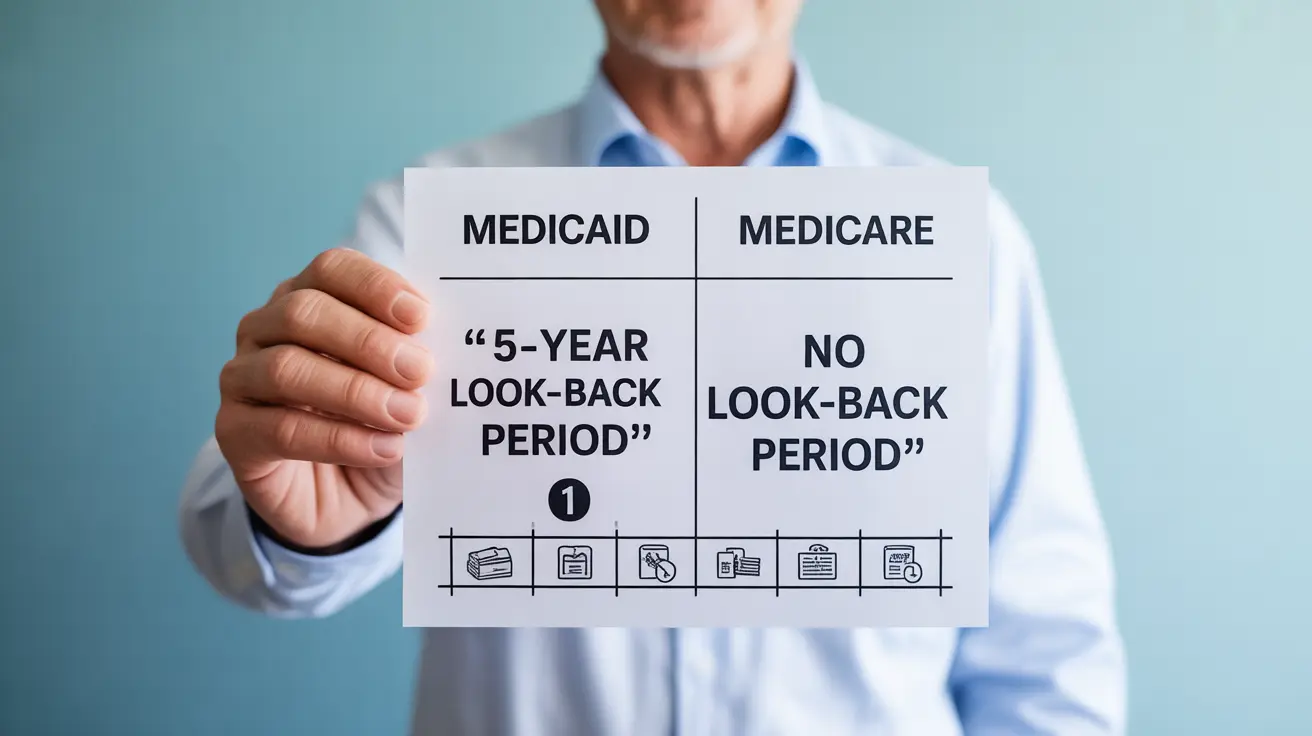

Medicare vs. Medicaid Look-Back Periods: Key Differences

While Medicaid has strict look-back requirements, Medicare's eligibility criteria focus more on age and disability status rather than asset transfers. Medicare beneficiaries typically don't face the same intensive financial scrutiny as Medicaid applicants.

Medicare Eligibility Requirements

Medicare eligibility primarily depends on:

- Age (65 or older)

- Disability status

- Work history and Medicare tax contributions

- Specific medical conditions

Planning for Long-Term Care

Understanding look-back periods is essential for effective long-term care planning. Consider these important steps:

- Consult with an elder law attorney

- Document all financial transactions carefully

- Maintain detailed records of asset transfers

- Plan well ahead of anticipated care needs

- Consider long-term care insurance options

Frequently Asked Questions

What is the Medicare look-back period and how does it affect my eligibility?

Medicare doesn't typically employ a look-back period for basic eligibility. Instead, eligibility is primarily based on age, disability status, and work history. The program focuses more on current circumstances rather than past financial decisions.

How does Medicaid's 5-year look-back period work when applying for long-term care?

Medicaid's 5-year look-back period examines all financial transactions made in the 60 months before applying for benefits. The program reviews these transactions to ensure that assets weren't transferred or sold below market value solely to qualify for Medicaid coverage.

What types of asset transfers does Medicaid review during its look-back period?

Medicaid reviews all types of financial transactions, including gifts to family members, property transfers, sales of assets, creation of trusts, and any transfers made for less than fair market value. This includes both large and small transactions.

Can I transfer property or money to family without affecting Medicaid eligibility?

Any property or money transfers to family members during the look-back period could affect your Medicaid eligibility. These transfers may result in a penalty period unless they meet specific exemption criteria or were made for fair market value.

What are the key differences between Medicare and Medicaid eligibility regarding financial history?

Medicare eligibility primarily depends on age and work history, with limited financial review. Medicaid, however, has strict income and asset limits, including the 5-year look-back period for reviewing financial transactions and asset transfers.