Navigating healthcare coverage when you have a disability can be complex, especially when it comes to understanding how Social Security Disability Insurance (SSDI) affects your Medicaid eligibility. This guide will help you understand the relationship between these important programs and how they can work together to provide comprehensive healthcare coverage.

Whether you're newly approved for SSDI or exploring your healthcare options, it's crucial to understand how these programs interact and what benefits you may qualify for. Let's break down the key aspects of SSDI and Medicaid eligibility to help you make informed decisions about your healthcare coverage.

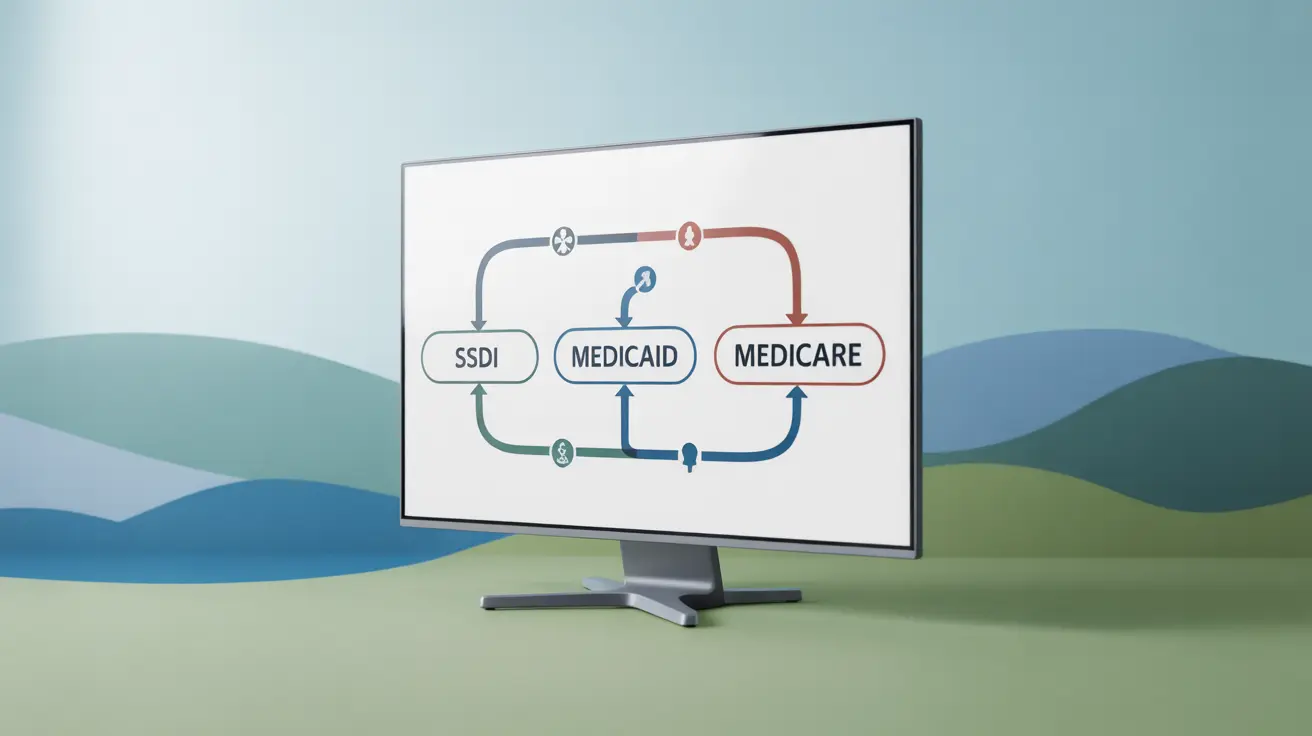

The Relationship Between SSDI and Healthcare Coverage

When you receive SSDI benefits, you may be eligible for different types of healthcare coverage, including both Medicare and Medicaid. However, these programs have different eligibility requirements and waiting periods that you need to understand.

SSDI and Medicare Waiting Period

After being approved for SSDI, recipients typically must wait 24 months from their disability onset date before Medicare coverage begins. This waiting period can create challenges for many individuals who need immediate healthcare coverage.

SSDI and Medicaid Considerations

During the Medicare waiting period, you may qualify for Medicaid coverage based on your income and resources. Each state has different eligibility criteria, but SSDI recipients often qualify if their income and assets fall below certain thresholds.

State-Specific Medicaid Programs

Many states offer specific Medicaid programs for people with disabilities. These programs may have different income limits and resource requirements compared to standard Medicaid programs.

Medicaid Buy-In Programs

Some states offer Medicaid buy-in programs that allow individuals with disabilities to work and maintain Medicaid coverage while earning more than traditional income limits. These programs can be particularly valuable for SSDI recipients who want to return to work.

Dual Eligibility Benefits

Some individuals may qualify for both Medicare and Medicaid, known as dual eligibility. This combination can provide more comprehensive coverage than either program alone, often with reduced out-of-pocket costs.

Coordination of Benefits

When you have both Medicare and Medicaid, the programs work together to cover your healthcare needs. Medicare typically serves as the primary payer, with Medicaid covering additional services and costs that Medicare doesn't cover.

Frequently Asked Questions

How does SSDI eligibility affect my chances of qualifying for Medicaid coverage?

SSDI eligibility doesn't automatically qualify you for Medicaid, but it can affect your eligibility. Your SSDI income must fall within your state's Medicaid income limits. Some states have special programs or higher income limits for people with disabilities.

When do SSDI recipients typically become eligible for Medicare benefits?

SSDI recipients generally become eligible for Medicare 24 months after their disability onset date. This two-year waiting period begins from the date you were determined to be disabled, not from when you started receiving SSDI payments.

Can I get Medicaid while waiting for Medicare coverage after being approved for SSDI?

Yes, you may qualify for Medicaid during the 24-month Medicare waiting period if you meet your state's income and resource requirements. This can provide essential coverage during the waiting period.

What is the difference between SSI and SSDI in terms of Medicaid eligibility?

SSI recipients typically qualify for Medicaid automatically in most states, while SSDI recipients must separately qualify based on income and resource limits. SSI is needs-based, while SSDI is based on work history and paying into Social Security.

How do Medicaid and Medicare benefits work together for people with disabilities?

For dual-eligible individuals, Medicare acts as the primary insurance, covering most medical services first. Medicaid then serves as secondary insurance, covering Medicare copayments, deductibles, and additional services that Medicare doesn't cover, such as long-term care.